On 20 June, the IPO audit status of Renben Corporation (hereinafter referred to as “Renben”) was changed to “terminated” by the Shanghai Stock Exchange.

Due to the withdrawal of the listing application by Renben and its sponsor, according to the relevant provisions of Article 63 of the “Shanghai Stock Exchange Rules for Review and Examination of Stock Issues and Listings”, the SSE terminated the review and approval of its issuance and listing.

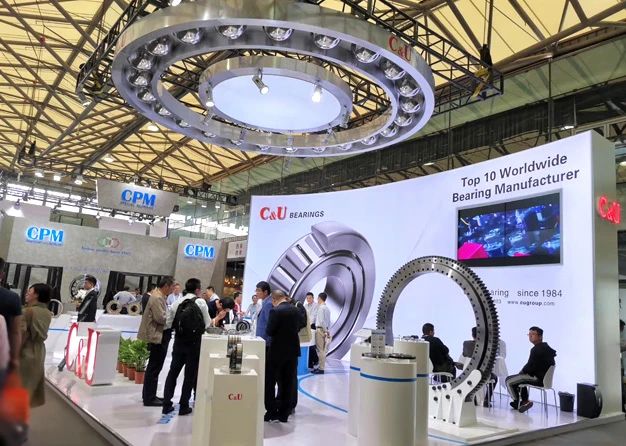

According to the prospectus, Renben is a large enterprise group engaged in the research, development, production and sales of bearing-related products, with more than 100 subsidiaries at all levels and more than 13,000 employees at home and abroad, and possesses the ability to support the whole industrial chain of bearings such as the research, development, production and sales of bearing materials, bearing components and finished products.

In China, Renben owns eight bearing R&D and production bases in Wenzhou, Hangzhou, Shanghai, Huzhou, Wuhu, Wuxi, Huangshi, Nanchong, etc., and has set up more than 30 sales subsidiaries in major bearing sales regions, Hong Kong and Taiwan.

Overseas, the company set up a bearing production base in the Philippines, set up R & D subsidiaries in Germany, set up sales subsidiaries in the United States, Germany, Japan and other countries.

The specifications of the bearings produced by RENBEN reach more than 30,000 types, basically covering all categories of rolling bearings.

According to product categories, the company’s main products can be divided into four categories: ball bearings, roller bearings, special bearings and bearing components.

The company’s finished bearings are widely used in many key areas of the national economy, such as automobiles, light machinery, heavy machinery and major equipment, etc. The company also sells bearing components to international leading enterprises in the field of bearing manufacturing. The company’s “C&U” brand was evaluated as the “Most Competitive Brand” by the Ministry of Commerce of the People’s Republic of China in 2006.

In terms of financials, Renben will achieve revenue of approximately RMB6.390 billion, RMB7.268 billion, RMB9.121 billion and RMB4.611 billion, and net profit of approximately RMB534 million, RMB773 million, RMB875 million and RMB372 million for the period of January to June 2019, 2020, 2021 and 2022, respectively.